Vinyl Terminated Silicone Fluid factory

Vinyl Terminated Silicone Fluid

Everything you need to know about our products and company

The production and application of vinyl terminated silicone fluid are undergoing significant transformation as new environmental regulations redefine global market dynamics. These high-performance materials, renowned for their thermal stability and chemical resistance, now face both challenges and opportunities arising from sustainability-driven legislation worldwide. This article examines how regulatory frameworks are influencing manufacturing processes, supply chain strategies, and innovation pathways in this specialized chemical sector.

Global environmental policies are increasingly targeting chemical production processes and material compositions. The European Union’s REACH regulation imposes comprehensive safety assessments for chemical substances, requiring manufacturers to provide extensive documentation demonstrating product safety for human health and the environment . Similarly, the Toxic Substances Control Act (TSCA) in the United States mandates rigorous evaluation of chemical compositions, pushing manufacturers to reformulate products to eliminate harmful substances .

The regulatory pressure extends to emissions control, with stringent restrictions on volatile organic compounds (VOCs) impacting production methods. The EU Industrial Emissions Directive and the US Clean Air Act have forced manufacturers to invest in closed-loop systems and emission-control technologies, increasing production costs by 12-18% for some producers . These compliance requirements have accelerated innovation in eco-friendly formulations but have also created significant entry barriers for smaller players lacking the capital for such investments.

The global regulatory landscape for vinyl terminated silicone fluids is characterized by significant regional variations that complicate international trade and production strategies. Europe has emerged as the most stringent regulator, with the EU’s Circular Economy Action Plan incentivizing silicone fluid use in closed-loop systems and restricting specific substances like cyclic siloxanes (D4, D5, D6) that were previously common in personal care applications .

North America presents a mixed picture, with California’s Proposition 65 banning octamethylcyclotetrasiloxane (D4) in consumer goods while other regions maintain less restrictive standards. This regulatory fragmentation forces manufacturers to maintain dual production lines for different markets, increasing operational costs by approximately $8 per metric ton for Asia-bound shipments from EU producers .

Asia-Pacific demonstrates varying approaches, with China implementing its 2025 Action Plan for Petrochemical Industries requiring manufacturers to cut carbon emissions by 18% per ton of silicone produced . Meanwhile, other regional markets maintain more lenient standards, creating havens for conventional production methods but potentially limiting access to regulated markets.

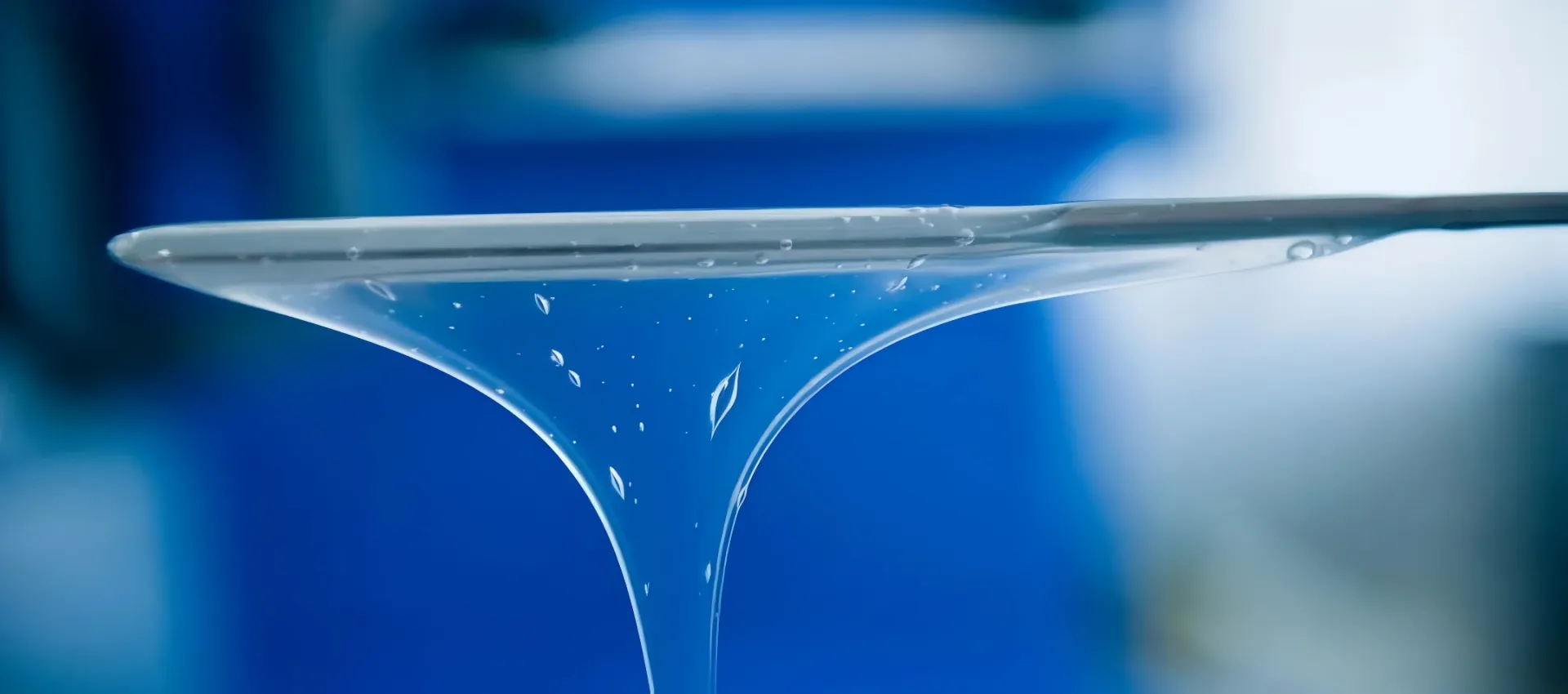

Environmental regulations are fundamentally transforming production methodologies for vinyl terminated silicone fluids. Manufacturers are increasingly adopting continuous processing techniques that replace traditional batch methods, accelerating production rates while minimizing waste . These advanced systems incorporate real-time monitoring that allows for precise control over chemical reactions, ensuring consistent product quality while reducing environmental impact.

Catalyst technology represents another area of rapid innovation, with new catalytic processes enabling lower reaction temperatures and shorter processing times. These advancements not only reduce energy consumption but also enhance overall yield, particularly valuable in producing high-purity fluids for electronic applications . Furthermore, manufacturers are increasingly utilizing bio-based feedstocks, with some companies developing vinyl terminated silicone fluids derived from renewable resources like rice husk ash silica, achieving up to 40% lower carbon emissions compared to conventional products .

The focus on sustainability extends to waste management, with regulations like the EU’s End-of-Life Vehicles Directive mandating 95% recyclability and driving demand for thermally stable silicone fluids in recycled automotive plastics . This circular economy approach is becoming increasingly embedded in production planning, with manufacturers designing products for recyclability and reuse from the initial development phase.

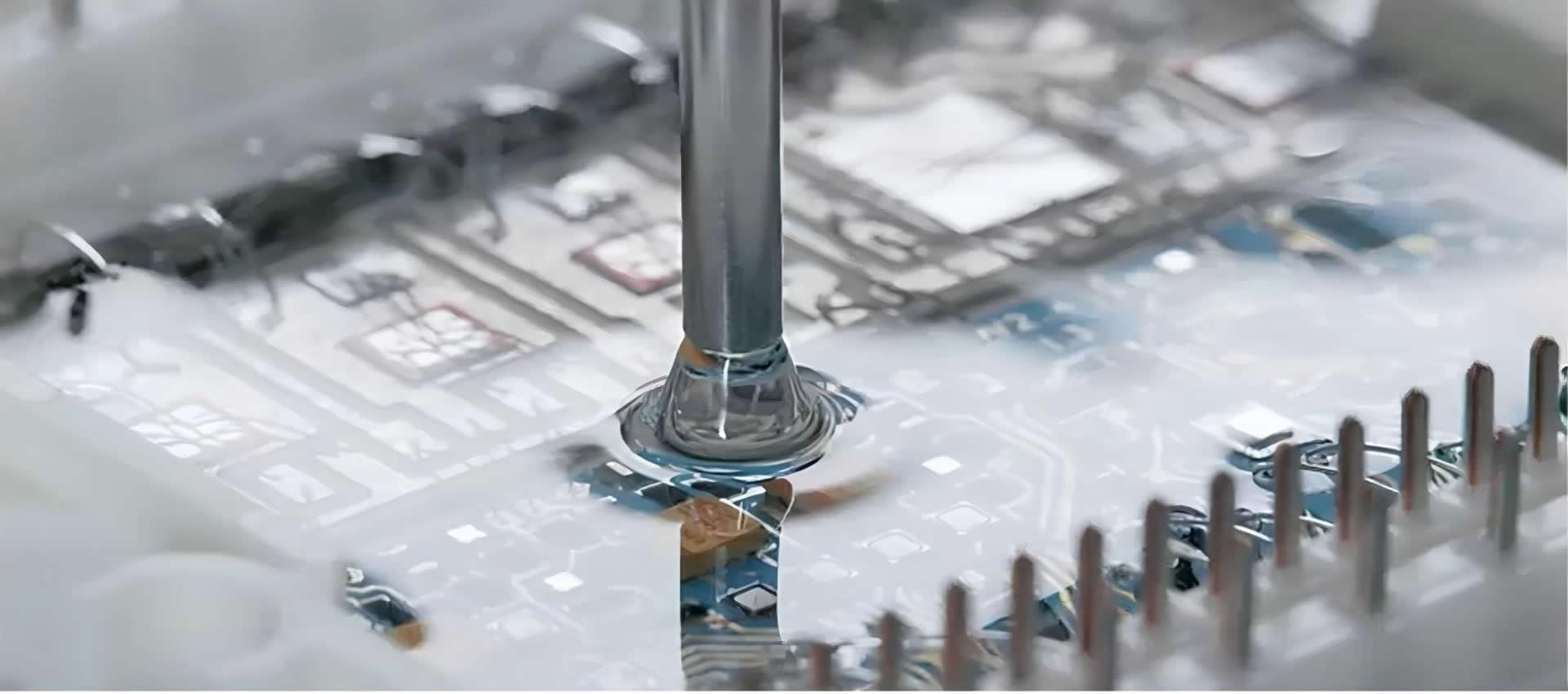

The regulatory environment is simultaneously constraining traditional applications while creating new opportunities in emerging sectors. The automotive industry, particularly electric vehicle production, has generated substantial demand for high-purity vinyl terminated silicone fluids used in battery thermal management systems . These applications require fluids with impurity levels below 50 ppm, driving innovation in purification technologies such as multistage molecular distillation .

The construction sector has seen increased adoption of vinyl terminated silicone fluids in sealants and adhesives due to their durability and resistance to environmental degradation. Regulatory emphasis on building sustainability and longevity aligns with the performance characteristics of these materials, which can extend service life by 15-20 years compared to organic alternatives . This is particularly relevant in projects like China’s “sponge city” initiative, which aims to achieve 80% urban stormwater absorption by 2030 through silicone-enhanced permeable concrete coatings .

Consumer goods represent a complex landscape, with regulations both limiting certain applications (such as restricting specific siloxanes in personal care products) while creating opportunities in eco-friendly formulations. The trend toward “clean beauty” has paradoxically benefited some silicone derivatives, as brands develop hybrid formulas combining silicone slip with natural oils . This reflects a broader pattern of innovation in response to regulatory pressures.

Leading companies in the vinyl terminated silicone fluid market have adopted diverse strategies to navigate the evolving regulatory landscape. Vertical integration has emerged as a key approach, with major producers securing long-term raw material agreements or investing directly in mining assets to mitigate supply chain disruptions . This strategy helps address vulnerabilities in silicon metal supply, which accounts for 60-70% of production costs and remains subject to significant price volatility .

Product differentiation through sustainability credentials has become another critical strategy. Companies like Wacker Chemie AG have emphasized eco-friendly manufacturing processes and formulations, positioning themselves favorably amid growing regulatory pressures . Similarly, Dow Silicones Corporation has invested heavily in research and development to create specialty silicones that meet evolving regulatory requirements while maintaining performance standards .

The regulatory environment has also driven collaborative approaches, with manufacturers engaging proactively with regulators to shape favorable policies rather than merely reacting to changes. This strategy allows companies to anticipate regulatory trends and align their research and development efforts accordingly, potentially gaining first-mover advantages when new regulations take effect .

Amid these regulatory shifts, Biyuan has emerged as an innovative player focused on addressing the sustainability challenges facing the industry. The company has invested significantly in research and development initiatives aimed at reducing the environmental impact of vinyl terminated silicone fluid production while maintaining the high-performance characteristics demanded by advanced applications.

Biyuan’s approach incorporates advanced catalytic technologies that minimize energy consumption during production, aligning with carbon reduction targets implemented in regions like China and the European Union. The company has developed proprietary purification processes that achieve the high purity levels required for electronic applications while reducing water consumption and waste generation compared to conventional methods.

Looking forward, Biyuan is exploring bio-based alternatives to traditional feedstocks, with promising research into silicone fluids derived from renewable resources. This focus on sustainable innovation positions the company to comply with increasingly stringent environmental regulations while meeting performance requirements across diverse applications from electric vehicles to renewable energy systems.

The regulatory environment for vinyl terminated silicone fluids will continue to evolve, with several trends likely to shape future developments. The harmonization of standards across regions may simplify compliance for global manufacturers, though significant disparities are expected to persist in the near term. Regulations targeting carbon emissions and promoting circular economy principles will drive continued innovation in sustainable production technologies and recyclable formulations.

The increasing focus on product transparency will likely expand, with regulators and consumers demanding fuller disclosure of material compositions and environmental impacts. Technologies like blockchain-enabled traceability systems are already being adopted by leading producers to document ethical sourcing of raw materials, with some manufacturers offering carbon-footprint calculators for batch-specific environmental impact assessments .

As regulatory pressures intensify globally, manufacturers that successfully integrate compliance into their innovation strategies will be best positioned to capitalize on emerging opportunities in markets increasingly shaped by environmental considerations. The future of vinyl terminated silicone fluid production will be characterized by continued adaptation to regulatory requirements, with sustainability considerations becoming central to product development rather than secondary concerns.

Our most popular products loved by customers worldwide

Vinyl termified silicone fluids represent a specialized class of medical-grade materials engineered for advanced healthcare applications. These reactive fluids feature terminal vinyl groups that enable precise molecular customization and controlled crosslinking capabilities, making them ideal for developing implantable devices, drug delivery systems, and d.

Vinyl silicone fluid is revolutionizing cosmetic and personal care formulations through its unique reactive properties and sensory enhancement capabilities. This functional silicone material features terminal vinyl groups that enable customizable cross-linking while maintaining the characteristic smoothness of silicone-based ingredients. Vinyl sili.

Vinyl silicone fluid, as a core functional silicone product, demonstrates exceptional versatility and reliability in the industrial additives sector. Its unique molecular structure combines the flexibility of a siloxane backbone with the reactivity of terminal vinyl groups, delivering customized solutions for various industrial applications. In polymer .

Vinyl terminated fluid is emerging as a transformative additive in textile and leather manufacturing, offering a unique combination of processing enhancement and performance optimization. This reactive silicone fluid leverages its terminal vinyl groups to create durable molecular bridges with fibers and leather substrates, delivering lasting functional ben.